GST Registrations: For the past several months, the government has been running a special campaign against fake GST registrations. Finance Minister Nirmala Sitharaman said that during the special drive in the last two months, GST officials have detected 21,791 fake GST registrations which had no trace. He said that during this special campaign, GST evasion of more than Rs 24,000 crore has been detected.

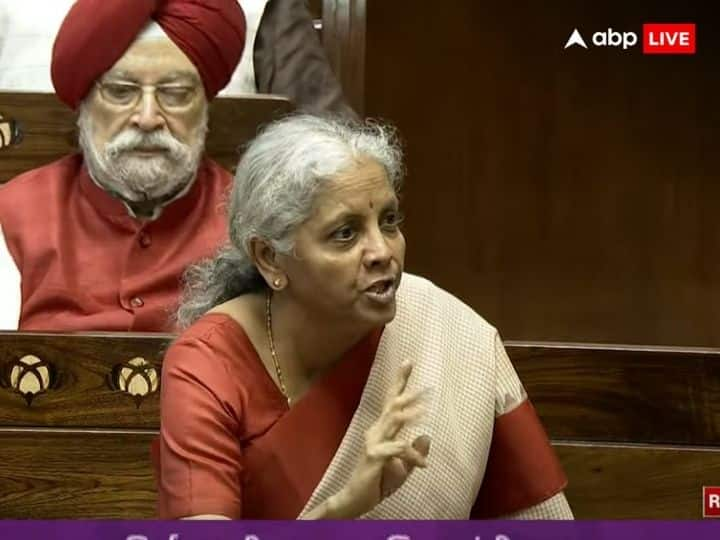

The Finance Minister was questioned about this in the Rajya Sabha during the winter session of Parliament. Rajya Sabha MP Mausam Noor had asked the Finance Minister a question regarding fake GST registration and total tax evasion by CBIC under the special campaign of CBIC between May to July 2023. In response to his same question, the Finance Minister said that a total of 11392 units under the tax jurisdiction of the state and 21791 units including the jurisdiction of CBIC have been detected which had filed fake GST registrations which were found to be non-existent. He said that states have detected tax evasion of Rs 8805 crore and CBIC has detected Rs 15205 crore, totaling Rs 24010 crore.

The Finance Minister said that in order to protect the interests of honest taxpayers and To save taxpayers from extreme hardship, instructions have been issued from time to time, in which officers have been directed to exercise due caution in the exercise of their powers.

Actually from 16th May to 15th July. , Transcript of a question asked about the number of entities identified as fake registrations and the total amount of tax evasion during the special campaign against fake GST registrations conducted by the Central Board of Indirect Taxes and Customs i.e. CBIC till 2023. She was replying.

On the other hand, in response to another question, the Minister of State for Finance said that online gaming companies should give reasons for the tax dues of Rs 1,12,332 crore for the financial years 2022-23 and 2023-24. Notice has been issued.

Also read

Get more latest business news updates