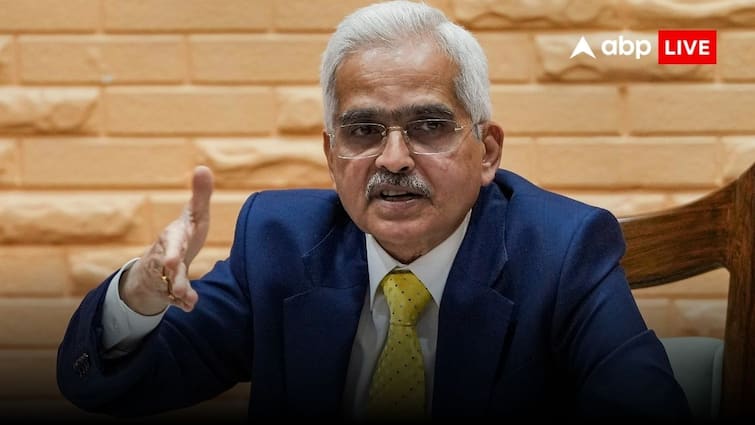

RBI Board Meet: A meeting of the Central Board of Directors of RBI was held under the chairmanship of Reserve Bank of India Governor Shaktikanta Das in which the Board reviewed the global and domestic economic situation. In this board meeting, RBI has also discussed the turmoil in the global financial market along with geopolitical challenges.

Reserve Bank of India issued a press release saying that the 607th meeting of the Central Board of RBI was held in Nagpur. In this meeting chaired by RBI Governor Shaktikanta Das, the board reviewed the domestic economic situation and outlook with the global one. In the meeting, the RBI Board also discussed the turmoil in the global financial market along with geopolitical developments. The RBI Board has also reviewed the progress made so far in digital payments during the financial year 2023-24, and the progress made in consumer education and awareness campaigns to create awareness among consumers. The RBI Board has approved the budget of the Central Bank for the accounting year 2024-25.

The RBI board meeting took place when the Statistics Ministry released the data and said that India's GDP during the third quarter was 8.4 percent. Also, the GDP for the financial year 2023-24 has been estimated at 7.6 percent. After the release of GDP data, many rating agencies and institutions have increased India's GDP estimates for 2024-25 in addition to the current financial year. According to Moody's, India's GDP may be 6.8 percent in the 2024 calendar year, which was earlier estimated to be 6.1 percent. It is a matter of relief for RBI that the retail inflation rate in February 2024 has been 5.09 percent.

The first meeting of the Monetary Policy Committee for the financial year 2024-25 will be held from 3 to 5 April. And the policy will be announced on April 5. The Federal Reserve has indicated to cut interest rates three times in 2024, after which it is being speculated that if the inflation rate remains close to 4 percent in the second half of the calendar year, then the RBI may also make the loan cheaper.

Also read

Get more latest business news updates